As adolescents and youthful grown-ups begin landing positions and financial records and getting from their folks always, they require an approach to track their cash. Since they do everything on their telephones nowadays,Money Tracker for Excel Template I planned this spreadsheet particularly for the portable form of Microsoft Excel. There is no connection to real financial balances, and that is deliberately (so you can track your cash without the danger of having your telephone connected to your real ledger). You can spare this record on your telephone and alter it without a web association on the off chance that you need to.

Money Tracker on Your Phone

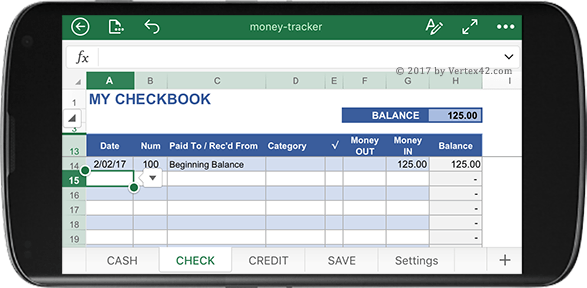

You'll require the free Microsoft Excel application on the off chance that you need to utilize this on your telephone. The following is a case of what the spreadsheet looks like when altering it in Excel on a telephone.

To make information section as straightforward as could be allowed, I included drop down records in Excel that let you select the present date and select from a rundown of basic payees. These drop-down boxes can be altered by means of the Settings worksheet.

Downloading to Your iPhone

It can be somewhat precarious to download the record to your telephone.Money Tracker for Excel Template You could download to your PC and transfer it to your Microsoft OneDrive record and access it that way. Or then again, you can utilize your telephone's program to download specifically to your telephone.

Utilizing the Safari App on your iPhone, when you download the document to your telephone and see it open the spreadsheet in another window, tap on the spreadsheet until the point that you see a "More..." connection or "Open in Excel" interface close to the highest point of the screen. There may likewise be a "Duplicate to Excel" symbol that will open the spreadsheet in Excel. You would then be able to spare it straightforwardly to your iPhone or to your OneDrive record on the off chance that you have that set up.

Learning Personal Finance Principles

When showing individual back standards to kids, a great place to begin with more youthful children is the Money Manager for Kids worksheet. Be that as it may, more seasoned children (secondary school) need to begin dealing with their own money and financial records rather than simply monitoring the cash their folks are holding for them. Thus, that is the thing that I planned this spreadsheet for.

I purposefully kept this spreadsheet as straightforward as could be allowed. In this way, it won't not utilize all a similar wording you would discover in a business application like Quicken, and it certainly won't have all the propelled highlights. The spreadsheet is intended to help a man ...

Figure out how to utilize a fundamental checkbook enlist.

Discover that money vanishes rapidly (you gain this just from attempting to track it).

Figure out how to monitor what they owe distinctive individuals (like obtaining $20 from their folks).

Figure out how to track investment funds objectives.

You'll see that every worksheet contains a checkmark (√) section. You can conceal this segment on the off chance that you would prefer not to utilize it. The motivation behind this segment is to give an approach to you to mark off every exchange that you have confirmed with your ledger or checked with a receipt ... or then again whatever else you should need to utilize it for.Money Tracker for Excel Template There is likewise a "c" and "R" alternative in this present segment's drop-down rundown in the event that you need to utilize it for denoting a "cleared" or "Accommodated" exchange. Keep in mind, you can alter what appears in these drop-down records in the Settings worksheet.

1. Track Your CASH

The CASH worksheet is to enable you to monitor what you have in your wallet or tote. Whenever possible, get and spare receipts. You wouldn't make sure to record each money buy you make, or you won't not have your telephone on you, or you won't have sufficient energy to refresh your spreadsheet on the spot. Sparing your receipts will enable you to refresh your spreadsheet later when you have additional time. In addition, you'll require receipts to influence returns and you to need to start reserve funds receipts for when you begin paying assessments.

Income (cash going out and coming in) is a vital idea to learn and when you begin paying bills and have different commitments, the subsequent stage in the wake of TRACKING your income is to PLAN it. You can utilize a month to month income spreadsheet to enable you to make an arrangement.Money Tracker for Excel Template We call this sort of spending design a "financial plan" however many individuals detest that word, so you can simply call your financial plan "design."

2. Track Your CHECKING Account

When utilizing a financial records, you would prefer not to bring about the charges and shame and discolored notoriety that originates from composing terrible checks (composing checks for more than the sum in your record). That implies you have to monitor your record adjust.

When you compose a physical check or make a store, your bank will be following everything for you. Most banks that I am aware of sweep the liquidated checks, so you can see the examined register when you log with your record. They may even incorporate a picture of the examined minds your month to month bank proclamation. You should keep a record of each check you compose and each check you store utilizing your physical checkbook enlist. It's additionally a decent propensity to compose the motivation behind the check in the update line on the check with the goal that when you see the online picture of a got the money for check, you can recall what it was really going after.

Individuals frequently utilize platinum cards more than composing checks, so you have to figure out how to monitor the adjust in your financial records other than your physical checkbook enroll (on the grounds that such a large number of individuals don't have their checkbook close by when making buys by means of a plastic). On the off chance that you have your card on you, you'll likely have your telephone on you, so utilize this spreadsheet or some other application to monitor your record adjust. Make sure to keep receipts for everything, not simply money buys.

3. Track Your CREDIT

Whenever you get cash from anyone, you have built up a CREDIT account with that individual. So regardless of whether you don't have a Visa, you may even now need to monitor cash that you owe. The CREDIT worksheet in this spreadsheet gives you a chance to pick WHO you are acquiring from or paying back, and the Account Balance section will disclose to you the amount you presently owe (or what amount is owed you).

Negative Balance: With a credit account, your Account Balance will as a rule be negative (implying that you owe cash).Money Tracker for Excel Template Indicating brackets () around a number like (25.00) is a typical method to speak to a negative esteem. On the off chance that you see a negative sum in the Account Balance segment, that implies you OWE cash.

Tithing: If you pay tithing, at that point you can consider tithing a CREDIT account. When you get salary (from looking after children, work, and so forth.) you should monitor the amount you owe as tithing. A few people set up programmed installments to leave their compensation checks to pay to particular magnanimous associations, however you'll require an approach to monitor different kinds of salary also. For instance, on the off chance that you get paid $25 in real money for looking after children, will include $25 in the CASH worksheet. You can likewise include $2.50 (10% of $25) in the CREDIT worksheet in the Money Owed segment subsequent to choosing Tithing from the Account segment. Afterward, when you PAY your tithing, you will enter $2.50 in the Money Paid segment, taking the sum you owe back to zero.

4. Track Your SAVINGS

Regardless of whether you utilize a money envelope or shake or a real ledger for your reserve funds, you will need to know the amount you have spared. Particularly on the off chance that you are attempting to put something aside to something particular, you'll require an approach to keep tabs on your development. Much the same as the CREDIT worksheet enables you to track the adjust owed to a specific loan boss, the FUND segment in the SAVE worksheet enables you to monitor the adjust in a specific investment funds FUND.

No comments:

Post a Comment