What is an investment funds snowball? The snowball technique is a kind of rollover system for both obligation result and reserve funds objectives.Savings Snowball Calculator Budget Template, An investment funds snowball is a cutting edge term for the old thought of assigning your reserve funds to different objectives in light of need and after that concentrating on one objective at time.

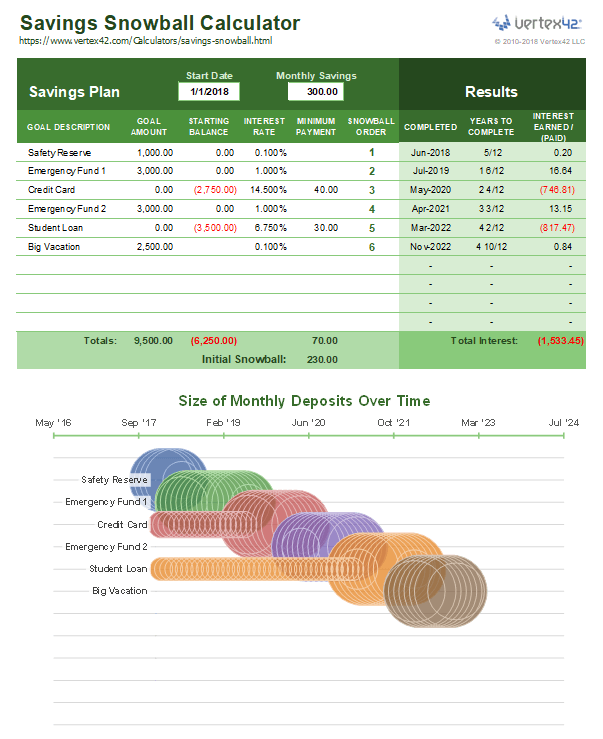

The Savings Snowball Calculator underneath is a simple to-utilize spreadsheet for Excel that can enable you to gauge to what extent it might take you to achieve your short-to-mid-term objectives. You can tweak your arrangement and try different things with sparing diverse sums.

The Savings Snowball Calculator underneath is a simple to-utilize spreadsheet for Excel that can enable you to gauge to what extent it might take you to achieve your short-to-mid-term objectives. You can tweak your arrangement and try different things with sparing diverse sums.

Savings Snowball Calculator

Remarks or Questions?

It would be ideal if you read the blog entry "Presenting the Savings Snowball Calculator" and utilize the remark area to share your remarks or make inquiries about this spreadsheet.

How Does a Savings Snowball Work?

The snowball is the measure of planned funds left finished subsequent to making least installments. Savings Snowball Calculator Budget Template, You toss the snowball at your best need objective until the point that it is finished, at that point you toss it at the following objective. Your snowball can increment as you pay off obligations and roll the beforehand required least installment into your snowball.

Case

Suppose you can bear to pay $200 every month towards your reserve funds and obligation result objectives, which are (arranged by need):

Spare $1000 as a wellbeing hold.

Pay off a charge card (which has a base installment of $30).

Spare $3000 in a just-in-case account.

At to begin with, the main required regularly scheduled installment is $30, so you have a snowball of $200-$30 = $170 that you will put into the wellbeing save.

When you have come to $1000 in your security hold, the $170 snowball is utilized to pay down the Visa.

After the Mastercard is paid off, the snowball develops to $200 (in light of the fact that you are never again paying $30 on the Visa). The whole $200 can be connected to the secret stash.

Disclaimer: This spreadsheet and the data on this page is for illustrative and instructive purposes as it were.Savings Snowball Calculator Budget Template, Your circumstance is interesting, and we don't ensure the outcomes or the materialness of this number cruncher to your circumstance. You should look for the counsel of qualified experts with respect to money related choices.

No comments:

Post a Comment